Key takeaways

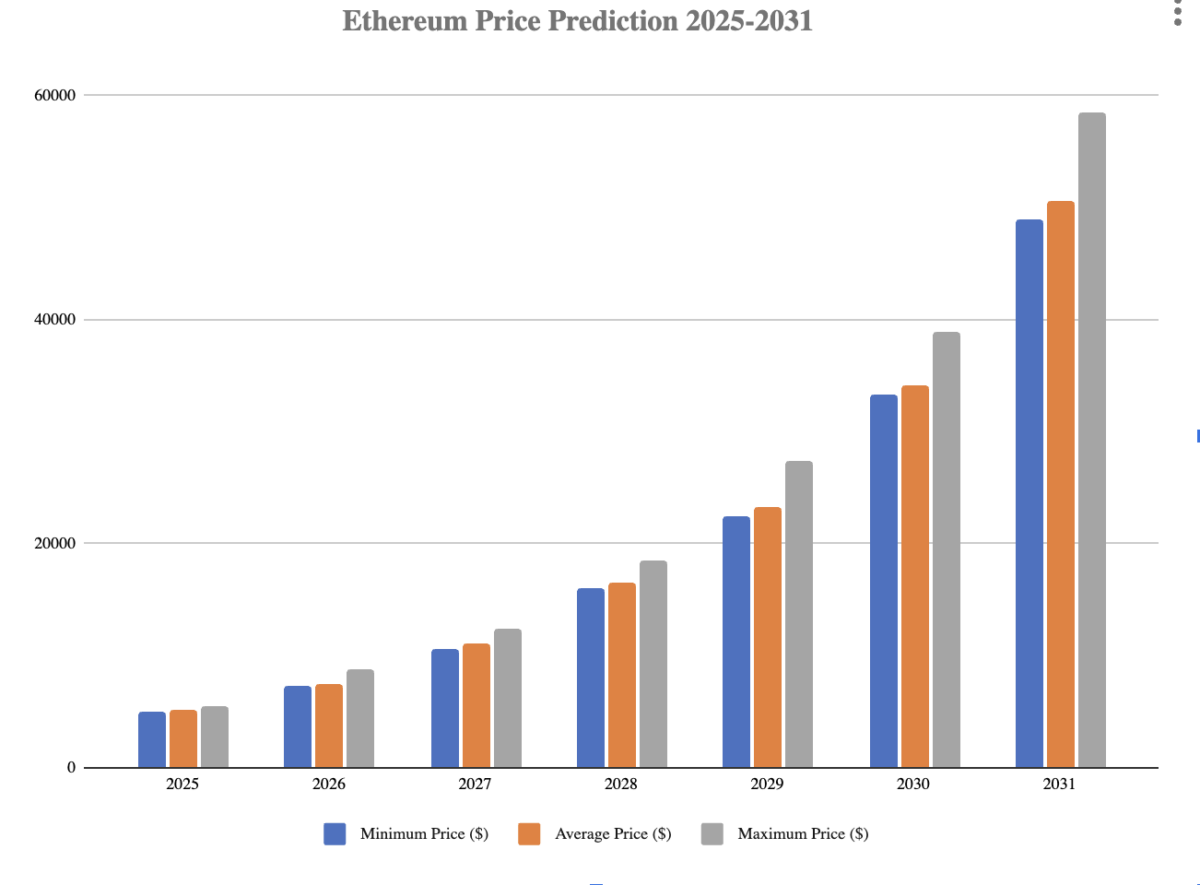

- Ethereum price prediction suggests an average market price of $5,458 by the end of 2025.

- In 2028, Ethereum is anticipated to trade between $15,431 and $17,750, with an average expected price of $15,859.

- In 2031, ETH could trade between $47,322 and $56,126 with an average price of $48,649.

The Ethereum network, launched in 2015, is a decentralized platform that enables developers to create smart contracts and dApps without intermediaries, enhancing security. The Ethereum blockchain is accessible to everyone and built to support scalability, programmability, security, and decentralization, allowing for the creation of secure digital technology. Its native digital currency, ether (ETH), and smart contracts have attracted investors’ recognition and interest, while developers appreciate its utility in developing blockchain and decentralized finance applications. It also helps traders trade Ethereum more easily.

So, what can traders and investors expect in the coming months and years? "Is ETH likely to go up? What will ETH be worth in 5 years?"

Let’s get into the details by exploring Ethereum’s price predictions from 2025 through 2031.

Overview

Ethereum price prediction: Technical analysis

Ethereum price analysis

ETH/USD 1-day chart

Based on the provided 1-day chart, Ethereum (ETH) shows bearish momentum, having recently dropped below the mid-Bollinger Band (around $2,594), signaling increased selling pressure. The next significant support lies at the lower Bollinger Band near $2,406. RSI at approximately 50 indicates neutral market sentiment, yet a slight downward bias is evident. Short-term expectations are bearish, with the possibility of ETH testing the lower support. Traders should closely monitor the $2,406 level; a rebound from here could suggest a consolidation phase or recovery, while breaking this level could signal further downside potential toward recent lower price levels around $2,200.

ETH/USD 4-hour chart analysis

Based on the 4-hour chart, Ethereum (ETH) demonstrates bearish momentum, trading below the mid-Bollinger Band ($2,705), and heading toward the lower Bollinger Band around $2,488, indicating heightened short-term selling pressure. The MACD is negative, reinforcing bearish sentiment, while Balance of Power reflects continued seller dominance. Immediate expectations point toward ETH testing the $2,488 support. Traders should closely monitor this level; holding it could initiate sideways consolidation or a minor bounce back toward $2,705. However, breaking below could amplify bearish momentum, potentially driving prices significantly lower. Vigilance at this critical support will be crucial in determining ETH’s near-term directional bias.

Ethereum technical indicators: Levels and action

Daily simple moving average (SMA)

Daily exponential moving average (EMA)

What can you expect from the ETH price analysis next?

Combining insights from both charts, Ethereum (ETH) is exhibiting bearish tendencies. On the daily chart, ETH is below the mid-Bollinger band (~$2,594) and trending toward a support around $2,406. The 4-hour chart reinforces this, with ETH trading beneath the middle band and approaching support at $2,488. MACD confirms bearish pressure across both timeframes. Expect ETH to test these immediate supports, with $2,406–$2,488 being critical zones. Holding this range might trigger consolidation or a slight recovery; failing it would significantly enhance bearish momentum, potentially pushing ETH further downward toward deeper support around $2,200. Traders should cautiously monitor these pivotal levels.

Is ETH a good investment?

Ethereum is the largest DeFi hub with a vibrant layer-two ecosystem in the crypto market. The blockchain constantly develops, making it a go-to choice for many Web3 developers. ETH, its native token, shows promise, and the possibility of an Ethereum ETF approval makes it favorable for day traders. Over the long term, explore our price predictions. However, the opinions expressed are not investment advice; traders should consider researching before investing.

A realistic price for Ethereum in 2025 is difficult to predict with certainty due to various factors such as market volatility, technological advancements, regulatory changes, and global economic conditions. However, some analysts and experts have made forecasts based on current trends and potential developments. These predictions can range widely, from a few hundred dollars to several thousands of dollars per Ether. For the most accurate and up-to-date analysis, it is advisable to consult recent financial reports and expert opinions.

The realistic price for Ethereum in 2025 is around $5,458 at the maximum.

What will 1 Ethereum be worth in 2030?

One Ethereum is expected to be worth $38,085, with a maximum projection for 2030.

How high can ETH realistically go?

Ethereum's price potential depends on multiple factors, including market trends, institutional adoption, network upgrades, and macroeconomic conditions. Realistically, ETH could reach $5,000 to $7,000 in the next bullish cycle if demand increases and Ethereum’s Layer 2 solutions and scalability improvements boost adoption.

If institutional interest strengthens, ETH may push past $10,000 over the long term, especially if Ethereum remains the dominant smart contract platform. However, volatility remains a key risk, with price corrections likely along the way. Regulatory clarity and Ethereum’s shift to proof-of-stake (PoS) efficiency could also positively influence its long-term valuation.

Will ETH reach $10,000?

Ethereum is projected to exceed $10,000 as early as 2027, with its potential low starting at $10,333 and a high of $12,545.

Will ETH reach $25,000?

Ethereum is predicted to surpass the $25,000 level by 2029 and reach a potential high of $26,554. This optimistic outlook is based on Ethereum’s ongoing development, network security, and increasing adoption. However, cryptocurrency markets are highly volatile, so long-term projections should be cautiously approached.

Will ETH reach $40,000?

Based on our analysis, Ethereum will likely reach the $40,000 mark. The highest expected price is around $56,126 in 2031.

Yes, Ethereum is widely considered to have a strong long-term future due to its robust platform for decentralized applications and smart contracts. However, like all technologies, it faces challenges and uncertainties that could impact its development and adoption.

Most well-known altcoins are trading at lower levels, but ETH is trading above its average price of the last two years. However, a positive outbreak can be expected. The ETH/USD pair is expected to reach the $56,126 mark by 2031, so holding it longer can be beneficial.

Recent news/opinion on Ethereum

At ETHGlobal, Ethereum co-founder Vitalik Buterin emphasized the urgent need for privacy solutions, urging developers to focus on four critical areas: private money, identity, voting, and messaging. He framed privacy as a civilizational priority, encouraging the ecosystem to build tools that safeguard individual autonomy in an increasingly digital world.

Ethereum announced that its much-anticipated network upgrade, Pectra, is coming to Mainnet on May 7th. According to the announcement, Pectra introduces EIP-7702 and many more features.

Ethereum price prediction for June 2025

In June 2025, Ethereum is projected to reach a minimum price of $3,772, an average price of $4,125, and a maximum price of $4,243.

Ethereum price forecast 2025

There are a number of changing aspects that may affect Ethereum’s success in 2025. Vitalik Buterin’s RISC-V plan might make Ethereum’s technical infrastructure stronger, which could bring in more developers and make it easier to scale. But the sudden drop in base layer activity and gas costs that are lower than they’ve ever been raise doubts about how many people want to utilize the network and how long it will last.

Ethereum might pick up speed again if it successfully executes protocol changes and Layer 2 solutions become more popular. Changes in the broader crypto market, new rules, and the adoption of crypto by businesses will also be very important. Ethereum’s price path in 2025 is still unclear and will be affected by both internal and external market factors, even if it has room to develop.

Ethereum’s price outlook remains optimistic, with projections suggesting the potential for new all-time highs, possibly reaching near $6,000, driven by adoption, innovation, and network growth.

However, external economic uncertainties or unfavorable conditions could pressure ETH prices toward an annual low of $4,825, with average estimates based on market sentiment hovering around $5,458.

Ethereum price predictions 2026 – 2031

Ethereum price prediction 2026

The price projection for Ethereum in 2026 shows that it has a lot of room to grow. The lowest expected price is $7,189, and the average price is $7,440, if the market is good. The highest price, on the other hand, may go up to $8,605.

Ethereum ETH price prediction 2027

Ethereum is expected to maintain its upward trajectory in 2027. However, the year’s predictions suggest a minimum price of $10,333, an average trading value of around $10,705, and a maximum price of $12,545. It is important to do your research before investing.

Ethereum price prediction 2028

Ethereum's price forecast for 2028 demonstrates steady appreciation. The potential low is estimated at $15,531, while the average price may reach $15,859 and the maximum price could rise to $17,750.

Ethereum ETH price prediction 2029

Ethereum's 2029 prices are expected to match those of 2029. The price range will be from a low of $21,969 to a high of $26,554 with an average of $22,603 signaling steady growth.

Ethereum price prediction 2030

By 2030, Ethereum’s forecast minimum price could rise to $32,258—while the expected average trading price is projected at $33,162. A potential high that may reach $38,085 showcases Ethereum’s increasing appeal to investors.

Ethereum price prediction 2031

By 2031, Ethereum’s price targets could reach a minimum of $47,322, an average of $48,649, and a maximum of $56,126.

Ethereum market price prediction: Analysts' ETH price forecast

Media news's Ethereum price prediction

Media news forecasts Ethereum’s price to range between $3,841.60 and $4,366.40 by the end of 2025. By 2031, prices may surge and trade at $44,900.80.

Ethereum historical price sentiment

- Ethereum began trading at $1.83 on March 13, 2016. By June 16, it surged to $14.48, surpassing a $1B market cap, but it dropped 45% to $11.33 on June 18 due to the DAO hack. By December 5, after a hard fork, the price fell further to $6.83.

- Ethereum recovered to $46.35 by March 16, 2017, and soared to $401.49 by June 12, during the ICO boom. It dipped to $157.36 by July 16 but rebounded to $253 by September 15.

- Ethereum surpassed $1,000 in January 2018 but dropped to $91.01 by December. Prices remained volatile between 2020’s high of $735 and low of $130.

- Ethereum started at $737, peaked at $4,293 in May 2021, and ended the year at $3,679, reflecting a year of significant growth.

- Prices declined to $1,196 by the end of 2022 amidst broader market downturns. In 2023, Ethereum started at $2,539, briefly rising to $3,595 in March before stabilizing at $3,117 in May and dropping to $2,458.90 by August.

- In November, ETH climbed as high as $3,739.93; in December, the coin is trading between $3,504.23 and $3,670.22.

- In December 2024, ETH reached a price of $3,349.

- As of January 2025, ETH is trading between $3,350 and $3,624.

- However, the closing price for Ethereum in January was $3,282.

- As of February 2025, ETH is trading at $2,796.

- The ETH value decreased further in March as it dipped to the $2000 range.

- At the end of March, ETH further declined and traded at $1,827.

- At the start of April, ETH traded at $1,917.

- Ethereum ended April at $1786. At the start of May, the ETH price is trading between $1804 and $1867

- Ethereum ended May at $2,521. In June, ETH is trading between $2,483 and $2,521.

0 Komentar